When it comes to banking and investments, you’ll often hear the term APY—Annual Percentage Yield. But what the heck does it actually mean? Why is it plastered everywhere when you’re just trying to open a savings account or invest your money? Let’s break it down in a way that even a New Yorker rushing for the subway can understand.

APY Explained

Table of Contents

APY, or Annual Percentage Yield, is the actual rate of return on an investment or deposit, accounting for compound interest. In simple terms, it tells you how much money you’ll earn on your savings or investments in a year, considering the magic of compounding interest. Banks use APY to show you how your money will grow if left untouched for a year. It’s an easy way to compare financial products like savings accounts, certificates of deposit (CDs), and money market accounts.

Unlike the regular interest rate, APY factors in how often interest compounds. Compounding is when the interest you earn starts earning interest itself—it’s the snowball effect for your money.

For example, if you have $1,000 in a savings account with a 5% interest rate, compounded monthly, your balance will grow slightly more than if it were compounded annually. That’s the beauty of APY—it reflects how fast your money really grows.

APY Formula

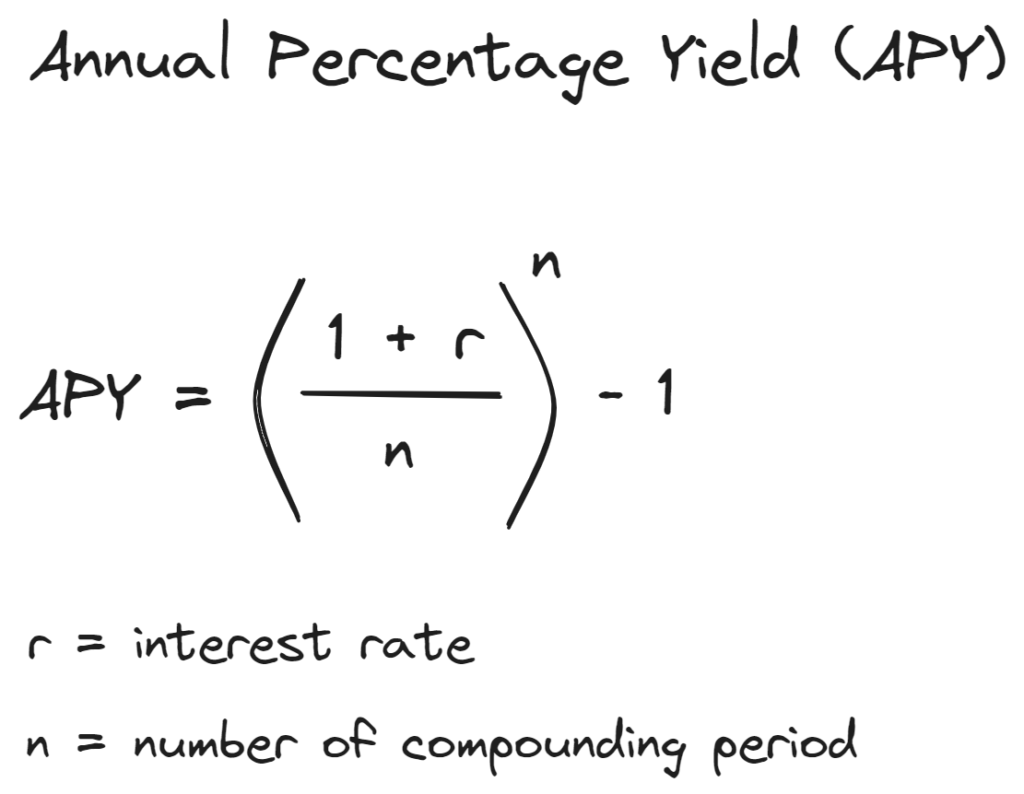

Ready for a little math? The formula to calculate APY is as follows:

APY=(1+rn)n−1APY = \left(1 + \frac{r}{n}\right)^n – 1

Where:

- r is the nominal interest rate (the rate advertised by the bank)

- n is the number of compounding periods per year (monthly would be 12, quarterly 4, and daily 365)

Example

Let’s say you have a savings account with a 5% interest rate (r = 0.05) compounded monthly (n = 12). Plug that into the formula:

APY=(1+0.0512)12−1=5.12%APY = \left(1 + \frac{0.05}{12}\right)^{12} – 1 = 5.12\%

This means that, due to the compounding effect, your real return on the account is 5.12%, not just 5%.

APY with Different Compounding Frequencies

| Nominal Rate | Compounding Frequency | APY (%) |

|---|---|---|

| 5% | Annually | 5.00 |

| 5% | Monthly | 5.12 |

| 5% | Daily | 5.13 |

| 5% | Quarterly | 5.09 |

As you can see, the more frequently your interest compounds, the higher the APY. Even though the differences might seem small, they add up over time.

How APY Works in Real Life

Banks use APY to make it easier to compare savings accounts or CDs. It levels the playing field because it factors in how often interest is compounded, which can vary a lot from one product to another. So, if you’re shopping around for a savings account, always look at the APY instead of just the interest rate. A 4% APY compounded daily will earn you more than a 4% APY compounded annually.

Example of a Real-Life APY Scenario

Let’s say you’re choosing between two different savings accounts. One offers 5% interest, compounded quarterly, and the other offers 4.8% interest, compounded monthly. At first glance, the first option looks better. But hold on! After you factor in compounding, the second option might actually give you a higher APY and, in turn, more cash in your pocket.

APY vs. APR

Don’t confuse APY with APR (Annual Percentage Rate). APR is the rate you pay on loans like mortgages or credit cards. Unlike APY, APR does not account for compounding. In fact, it usually includes fees and other costs. APY is about what you earn, while APR is about what you pay.

When Does APY Matter Most?

APY matters most when you’re looking to grow your money over time. If you’re putting cash into a high-yield savings account, CD, or investment account, APY is your best friend. It tells you exactly how much interest your money will earn—making it easier to compare offers and choose the best one.

For example, if you’re trying to decide between two 1-year CDs, one offering a 4.5% APY and the other offering 4.3%, you know the first one will give you a bigger return. And while the difference might seem small, that extra 0.2% adds up over time.

Impact of Compounding on Long-Term Investments

The longer you leave your money in a compounding account, the bigger the difference APY makes. Over a few years, it could mean earning hundreds or even thousands of dollars more than you would with an account that compounds less frequently or has a lower APY.

FAQ’s

What’s the difference between APY and interest rate?

The interest rate is the percentage the bank pays on your deposit or investment, but it doesn’t account for compounding. APY, on the other hand, includes compounding, giving you a clearer picture of how much you’ll actually earn over a year.

For example, a bank might offer you a savings account with a 1.5% interest rate, but with monthly compounding, the APY could be 1.51%.

How often is APY compounded?

It depends on the product. APY can be compounded daily, monthly, quarterly, or annually. Savings accounts often compound daily, while CDs might compound monthly or quarterly. The more frequent the compounding, the higher the APY. So, look for products with more frequent compounding periods if you want to maximize your returns.

How can I calculate how much I’ll earn with APY?

To calculate how much you’ll earn, multiply your principal amount by the APY, then add that to the principal.

Example: You deposit $1,000 into a savings account with a 5% APY. In one year, you’ll earn $50. If that interest compounds monthly, your balance will grow by a bit more—around $51.16—thanks to the magic of compounding.

Is APY variable?

It can be. Some accounts offer fixed APYs, like many CDs, where your rate is locked in for the term. Other products, like regular savings accounts, offer variable APYs, meaning the rate can change based on market conditions, like when the Federal Reserve changes interest rates.

Conclusion

At the end of the day, APY gives you the real deal on how much money your investment or savings will earn in a year. Whether you’re opening a savings account, CD, or just trying to figure out which investment will give you the most bang for your buck, APY is the magic number you need to pay attention to.

The best part? You don’t have to be a financial genius to figure it out. Just compare the APY between products, and always aim for the highest one with the most frequent compounding. If you need help choosing the right financial product or have questions about growing your money, contact us—we’ll help you navigate the options and find the best deal for you.

This article uses APY-related keywords to help you make the most informed decisions about your financial future. Remember to think long-term, let compounding work its magic, and keep an eye on the APY for your savings and investment products.